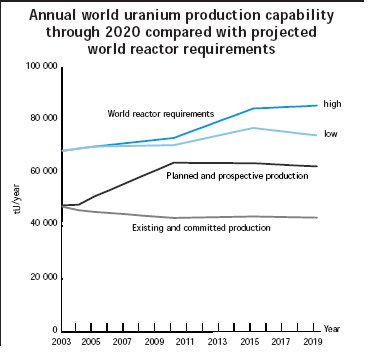

NEA News 2004 Volume 22, Number 1 Uranium production and demand: timely mining decisions will be neededR.R. Price, J.R. Blaise, R.E. Vance*Uranium resources are abundant. At the beginning of 2003, total known conventional resources (recoverable at <USD 130/kgU) were about 4 590 000 tonnes of uranium (tU). The addition of more speculative resources yet undiscovered but believed to exist based on geological evidence adds about 9 790 000 tU, amounting to total estimated uranium resources of about 14 380 000 tU. Based on the world’s reactor-related requirements in 2002 (66 815 tU), these resources are sufficient for several centuries. However, for a variety of reasons, current production is maintained below demand. In 2002, uranium mine production in 20 countries amounted to about 36 040 tU. The seven leading producing countries, in descending order, were Canada, Australia, Niger, the Russian Federation, Kazakhstan, Namibia and Uzbekistan. Together, these countries provided over 85% of the global output. The two largest producers, Australia and Canada, alone accounted for over 50% of global primary production.  Primary production, therefore, only provided about 54% of world reactor requirements at the end of 2002. The remaining demand was met using secondary sources, such as excess commercial inventories, low-enriched uranium (LEU) derived from highly-enriched uranium (HEU) warheads, reenrichment of tails and spent fuel reprocessing. In OECD countries the need for secondary sources was even more pronounced since OECD mine production in 2002 (20 114 tU), even accounting for the two largest producers in the world, provided only about 36% of OECD demand (55 490 tU). By the year 2020, reactorrelated uranium requirements are projected to rise to between 73 495 tU and 86 070 tU (low and high demand scenarios, respectively). As currently projected, future primary production capability (including existing, committed, planned and prospective production centres supported by known conventional resources recoverable at a cost of <USD 80/kgU) will not be able to satisfy projected world uranium requirements in either a low or high demand case (see Figure). Primary production capability in 2020 will satisfy only 73-85% of the high and low case requirements. Moreover, these figures can be considered conservative given that production rarely attains 100% of nameplate capacity. Therefore, secondary sources will remain important in meeting world uranium requirements. However, secondary sources are expected to decline in availability, particularly after 2020, and therefore reactor requirements will have to be increasingly met by primary production. This will thus require the expansion of capacity at existing production centres, the restarting of idled or shutdown production centres, the development of entirely new production centres or the introduction of alternate fuel cycles. In considering the need for increased primary production and the potential for developing new production centres to provide it, it is necessary to account for the time needed to discover and develop new uranium production capability. The lead time for the discovery and development of new uranium production facilities has been of the order of one to two decades (see Table). A variety of factors have contributed to these lag times, such as market conditions, business decisions, environmental assessments and licensing requirements or technical difficulties. Nonetheless, such long lead times could potentially create uranium supply shortfalls, with significant upward pressure on uranium prices as secondary sources are exhausted. The long lead times underscore the importance of making timely decisions to expand production capability well in advance of any projected supply shortfall. World electricity use is expected to continue growing to meet the needs of an increasing population and economic growth. Nuclear electricity generation is expected to continue to play an important role in the energy mix over the next few decades, at least. It may be called upon to grow considerably. While uranium resources are adequate to meet future projected requirements, a concerted effort will be required to ensure that new resources are developed within the time frame required to meet future demand without shortfalls arising.

Related linksTable of contents, NEA News No. 22.1 * Mr. Robert R. Price (robert-rush.price@oecd.org) works in the NEA Nuclear Development Division; Mr. Jean-René Blaise (jrblaise@cogema.fr), former IAEA Secretary of the Uranium Group, currently works for Cogema; Dr. Robert E. Vance (rvance@nrcan.gc.ca) works in the Uranium and Radioactive Waste Division of Natural Resources Canada. |